Tokyo’s New International Airport Opens & no one cares

Two days ago, on March 11 2010, the new Tokyo-Ibaraki Airport (IBR) opened. The inaugural flight to arrive was an Asiana Airlines‘ Airbus A321 from Incheon International Airport (ICN) followed by … well by nothing else…

…normally the opening of an international airport is big news celebrated by promotions and fanfare. While the opening of Ibaraki Airport was celebrated with marching bands at the airport itself, it was being celebrated by head scratching and finger pointing everywhere else.

Tokyo is a very competitive market. Landing slots at Tokyo’s Narita Airport (NRT) are highly sought after, and a battle for slots into the coveted Haneda Airport (HND), which has previously been closed to US and European airlines, is raging among US airlines. So why are no airlines looking at Ibaraki Airport? There are a number of factors involved in very few airlines having any interest in Ibaraki Airport.

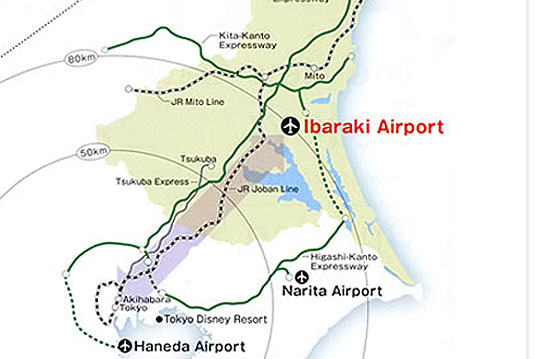

The primary barrier for any airline having interest in Ibaraki Airport is its location. Anyone who has traveled to Tokyo via Narita Airport knows that Narita, the primary international gateway to Tokyo, is far removed from the city, roughly 48 miles (77km) from Shinjuku Station in central Tokyo. Traveling to Shinjuku from Narita is a hassle and a long ride, but it is manageable with public transportation…

…Ibaraki Airport is located 96 miles (155km) from Shinjuku and offers passengers virtually no public transportation. Currently the only public transportation options from Ibaraki Airport to Shinjuku are a series of buses with a travel time averaging 3hrs 35min. Ibaraki Airport is publicizing an airport limousine bus with a travel time of 85 minutes, but that travel time appears to be based on a magical highway that does not exist and assumes the nonexistent magical highway has no traffic.

Ibaraki Airport offers attractive landing fees for airlines that are substantially lower than that of Narita Airport and Haneda Airport. For example, the landing fee for an Airbus A330-200 at Narita is Â¥430,300 (US$4,757) and Â¥552,000 (US$6,102) at Haneda, while the same A330-200’s landing fees at Ibaraki are a mere Â¥265,090 (US$2,930). While reduced landing fees are attractive, airlines only fly to airports that can sustain passenger traffic to generate revenue.

The facilities at Ibaraki Airport are minimal. While the airport is now marketing itself as a low cost airline hub, the facilities at the airport do not appear to be viable to creating an airline operational hub. A feature missing from the airport are jetways, all passengers board aircraft via stairs on the ramp. While the lack of jetways is not a big deal, the check-in counter area is condensed into a single area on the lower floor of the terminal, which can be problematic. The check in area design makes expansion challenging should a low cost airline want to set up a base of operations at the airport.

Another barrier for creating a low cost carrier hub at Ibaraki Airport is parking, airport parking is limited to 1,300 cars. Figure a low cost airline flying an Airbus A320 is fitted with 183 seats; realistically parking is available for less than 20 flights (since obviously not every passenger arrives in their own car, which would mean parking was available for less than 8 flights).

If Ibaraki Airport really wants to market itself as a low cost carrier hub as the Government is saying, hub airports need a lot of gate space. Presently the ramp area at Ibaraki Airport can accommodate a single Boeing 767 along with three Boeing 737s, or five Boeing 737s with some ‘creative parking.’ This ground space is very limiting for any growth potential.

Overall, the creation of Ibaraki Airport can be equated to Alaska’s ‘Bridge To No Where.’ It is a vanity project that was funded by the local and regional governments so they could have a commercial airport in their area. An airport is only viable if airlines fly to it and passengers board those flights. At the moment Ibaraki Airport will continue to have one flight per day, Asiana Airlines to Incheon, South Korea. In about a month Skymark Airlines will launch daily service to Kobe Airport (UKB) … so the airport will have two flights per day. No airport of such limited commercial revenue and no ‘general aviation‘ revenue can survive on 2 flights per day.

With Japan’s airline industry in distress, and the country’s national flag carrier Japan Airlines, filing the largest bankruptcy in the history of Japan you’d think the Government should try and fix the bloated and failing commercial airline industry before adding more entities that will require public funds to survive.

Below is a map of the Ibaraki Airport in relation to Tokyo and its two primary gateways, Narita and Haneda Airports.

Happy Flying!

As a Tokyo resident, I wish more flights could come into Hanaeda. Then again it’s probably quicker to take the express to Narita than it is to piece together my journey to Hanaeda.

Narita is pretty painless to get to, just takes time, but once you’re on the train you just sit on it until you arrive in the terminal. The airport express trains run from all over the city too.

Ibaraki is a joke, I get the impression it’s an excuse to upgrade the airforce bases’s facilities without using military funding, but I may well be wrong. Definitely will be avoiding any flights that make use of it…

Paul,

I agree, the Narita Express is fairly painless, it is just a long train ride. While the N’EX sells tickets with assigned seats, I have been on it while it was jammed packed and felt like a Tokyo subway car on one occasion…and that made for a long ride.

My description of Narita, in regard to Ibaraki is that its not in a convenient location to the city … and the new airport is twice the distance from Tokyo. From what I understand the local and regional governments wanted to build a low cost carrier hub for Tokyo and settled on Ibaraki. The original plan was to attract 800,000 passenger annually, however should the airport meet its basic estimated expectation (which right now looks unlikely) it should attract 200,000 passengers (again, not looking likely).

Rather than Low Cost Carrier IBR has attracted a single flight per day by Asiana (and airline far from being described as an LCC) who appears to be flying people in for golf trips since the airport is surrounded by golf courses. Skymark is looking at the ‘greater suburban Tokyo market’ for flights to Kobe, to possibly be expanded to two other destinations this year, but they are not even committed to one full year at IBR. Skymark even lobbied to not be required to move staff to the airport permanently. Asiana has not assigned a permanent station manager to IBR with its service in place.

Hanaeda should be interesting when US airlines begin operations to the airport possibly followed by a few major European airlines.

Happy Flying!

-Fish

I?ve been exploring for a little bit for any high quality articles or blog posts on this sort of house . Exploring in Yahoo I eventually stumbled upon this web site. Reading this info So i?m happy to exhibit that I have a very excellent uncanny feeling I came upon just what I needed. I most certainly will make certain to do not disregard this site and provides it a glance regularly.